Responsible Investment

Environmental, Social & Governance

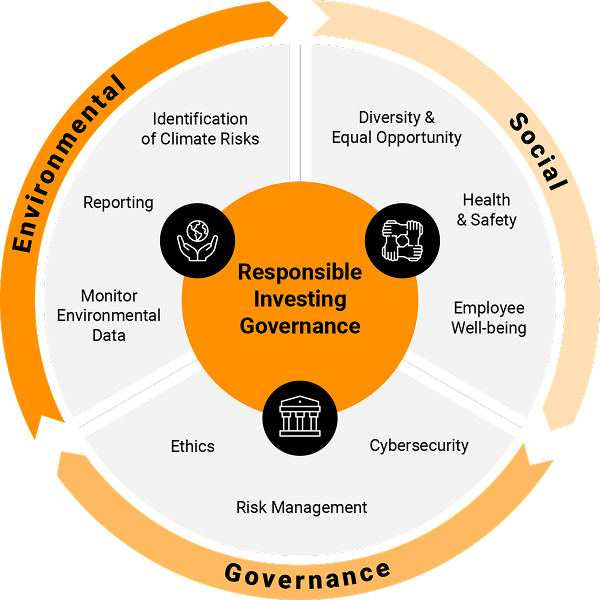

Cloud Capital aims to be a responsible investment firm that creates sustainable long-term value for our investors and wider stakeholder groups.

We recognize and take on our responsibility to conduct our investment business in a responsible way and, to the best of our ability and in line with our fiduciary duties, we aim to deliver superior investment returns whilst minimizing the cost to society and to the environment as far as possible.

We recognize the importance of setting targets for managing ESG performance, mitigating sustainability-related risks and for identifying value creation opportunities. In line with this, we aim to set long term targets for key initiatives and monitor progress year-on-year.

Our responsible investment approach is informed by the UN Principles for Responsible Investments and our policy is reviewed at least annually.

Aligned to our overall sustainability strategy, Cloud Capital has also established a Green Finance Framework to govern the issuance of green finance instruments, including green bonds, green loans, green asset-backed securities (ABS) and green tranches of ABS. Our framework is aligned to the four core components of the International Capital Market Association’s Green Bond Principles and the Green Loan Principles.

Environmental data: We measure and monitor environmental data at assets directly under management.

GHG emissions: Most of Cloud’s emissions are scope 3 emissions (around 98%) and we have begun work to set net zero targets to reduce our emissions in the next 12 months.

Environmental due diligence on portfolio acquisitions

Conservation of biodiversity during construction

Climate Risk Awareness survey conducted in 2023, as part of efforts to improve our climate risk governance and overall climate strategy.

Green certifications: Three of our assets are LEED Gold certified.

Employee wellbeing program addressing health and safety matters for its employees.

Employee satisfaction: In 2023, we conducted our first annual employee satisfaction survey.

Professional development: We conduct annual performance reviews for all employees, and provide them with training and development opportunities.

Tenant Engagement: Cloud continues to develop its tenant engagement programme

Tenants have ambitious sustainability commitments

Responsible Vendor strategy

Policies including:

- Code of Ethics

- Whistleblower

- Financial crime

Committee Structure including:

- Investment

- ESG

- Governance

- IT Risk & Information Security

ESG training: management and employees engage in annual ESG awareness training.

Cybersecurity and Information Security programme which is overseen and reviewed annually by external cybersecurity consultants.

Signatory to the Principles for the Responsible Investment since 2022

Cloud Capital made its first submittal to GRESB in 2023 determining to use the output as a base line for ongoing improvements to meet investor standards

In 2023, Anthesis, the dedicated sustainability consultancy, was engaged to identify and implement ESG performance improvement actions.